Borrowers will see their credit score take account of rental payments for the first time under a major overhaul being rolled out by Experian to better reflect how credit applications are assessed by lenders.

The changes will see Experian offer a more detailed view of information on credit reports and ways to improve scores.

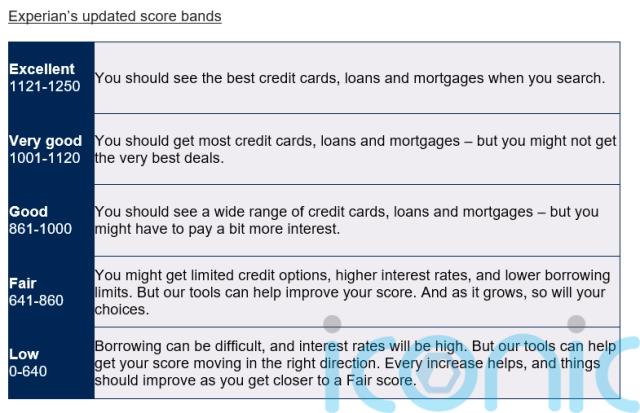

It includes an expansion of the score range, from 0-999 previously, now up to 1,250, with the five bands also updated with new names and refreshed descriptions – scrapping “poor” and “very poor” and the use of the colour red to be less distressing to borrowers.

More than 40% of people (44%) are set to drop down a score banding after the changes, given the expanded scoring.

Experian said 42% are also likely to move up a banding, while 14% will see their score band remain the same.

Experian stressed the changes will not impact on someone’s ability to get credit, while eligibility for mortgages, loans or credit cards remains unchanged.

A credit score is a personalised number that lenders use to assess creditworthiness, or how likely a borrower is to repay money.

A higher score means borrowers are more likely to get approved for a loan and offered better rates.

The new model takes account of new data, such as rental payments, as well as financial behaviours that banks and lenders increasingly value, it said.

This includes cutting overdraft use, avoiding credit card advances and making mortgage overpayments, as well as a more detailed look at regular payments on mobile phone contracts and how often a customer may switch provider.

The scoring changes will give people a clearer picture of their borrowing potential and more ways to improve their score, according to Experian.

Edu Castro, managing director of Experian consumer services in the UK and Ireland, said: “The way people manage their money has evolved, and our score has evolved too.

“Our new Experian credit score better reflects more of the everyday financial behaviours that matter – like paying rent or reducing overdraft use – offering a clearer understanding of the information on your credit report.

“This means people get a more personalised view of how they’re doing financially and more practical ways to improve their score, helping unlock better borrowing opportunities for the future.”

People expected to benefit from the changes in particular include those looking to improve their score, while it is also particularly helpful for those with a limited credit history.

The new scoring will start to be rolled out in November and will reach all UK customers by the end of 2025, with existing customers seeing their score automatically updated and emailed once available.

Those using the free app and credit score service will be able to access the new features, with indicative examples of how scoring is affected by financial behaviours, while a more detailed and personal assessment is available on the paid-for service.

Borrowers can also access their full credit report for free.

Experian – one of three main credit reference agencies – said lenders are looking for three key points when someone makes an application for credit: affordability, including income, employment status and expenditure; their credit report and score, looking at how they have managed credit in the past six years; and the lender’s own records, looking at whether they have been a customer with that lender before.

A coalition of MPs, lenders, business groups and charities have written an open letter to Chancellor Rachel Reeves calling for a co-ordinated national approach to ensuring rental payments are consistently included in credit scoring.

They are urging her to use the upcoming publication of the Government’s national financial inclusion strategy to make reforms to address the issue, with renters having the right to opt-in to have rental payments added to credit files and the creation of rental data reporting schemes.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.