Women already have a gender pay gap to contend with but experts say that’s also one of the factors leading to financial inequality in retirement.

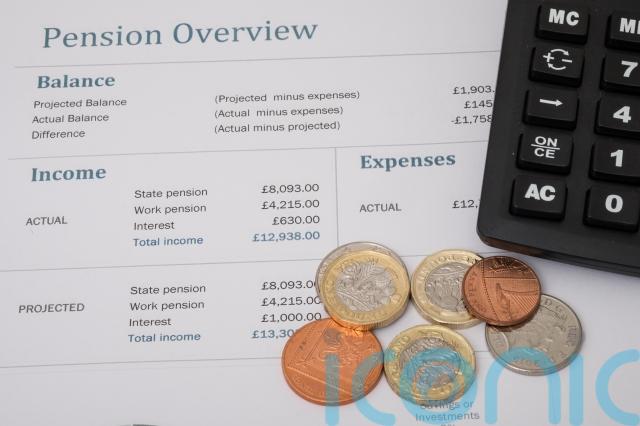

Scottish Widows 2025 Women and Retirement Report found that the gender pension gap is actually growing – and is now at 32%. Women are on track to finish work with an average annual retirement income of £13,000, compared to men’s £19,000.

So why is it happening?

Rowan Harding DipPFS, a financial planner at Path Financial, points out that a heavier burden of caring responsibilities (of children and older generations) is more likely to fall to women.

“There are individuals – and predominantly it tends to be women more than men – where they will have periods where they are not in paid work,” she says. “They might still be ‘working’, but it’s not paid in a formal sense, and that tends to leave those individuals, and as I say, probably more women, with less ability to put aside money for the longer term future.”

Taking maternity leave, or a longer period of time out of work to be the primary carer, or even reducing hours to part time to manage increasing costs of childcare and kids’ school schedules – all contribute to less money in the pension pot.

But you don’t need to have children to be affected by the gender pay gap.

“Women will tend to be in the same positions, in the same roles, earn less than men, and so therefore there is less available for them to decide for that longer term future,” says Harding – “And that’s probably one of the more subtle issues around the gender pension gaps.”

The inequality “happens over a number of years”, she notes, “so it’s one of those things that you don’t quite realise it’s happening until further down the line that you see that disparity, that inequality, people don’t think about in their 20s and 30s.”

What should women do to ensure a healthier retirement pot?

1. Think about it in your 20s

“The key thing is, if you’re working for an employer, join the employer’s pension scheme as early as you can. If your employer does offer pension contributions which are above the minimum amount of 3%, take them up on that offer, if it’s affordable to you, because it’s kind of free money into your pension,” Harding says.

For self employed or business owners, “As soon as you can get yourself a pension set up – be sensible about how much you can afford to put in – but the sooner you start the better.”

2. Consider some financial advice

“Try and get a financial plan in place sooner rather than later,” advises Harding, “So you’ve got an idea of, how much do I need to consider accumulating over a lifetime? What are my aims? What are my goals? A really good financial plan will help you to realise that.

“The other thing to consider is really regularly, once a year, maybe more often, but thinking about budgeting and expenditure. So where is your money going if you are lucky enough to be in employment and you’re able to put aside for the future. Thinking about how much of a percentage goes towards various different things – what can you afford to actually put aside for the longer term?”

3. Think about your aims for next year

Consider increasing your pension contributions. If your aim is say, “‘I want to increase the amount that goes into my pension by £20 a month, £50 pounds, £250 a month’, whatever is suitable for individual circumstances. Then great, make that happen,” says Harding.

“I think we can all procrastinate. I think there’s lots of things that women can do to help with boosting their pension savings much earlier on in their careers.”

If you’re later in your career and want to increase contributions, Harding suggests small but regular increases into your pension.

“Set it up incrementally as soon as you get paid and then gradually you increase that, whether it’s every six months, every 12 months, every month even, would be great.

“And all of a sudden it then starts to become the norm and familial, and it’s just much easier, rather than suddenly going from just pay in the minimum amount from the workplace pension schemes – 3% on the employer, 5% on the employee – to them suddenly thinking, ‘I need to put 20% of my income aside into the pension’ – that’s a big jump in one go.”

4. If you take a career break, ask your partner to contribute to your pension

“It doesn’t have to just be you that pays into a pension,” notes Harding, “You could get a third party to pay in, so that could be a family member, that could be a partner. Regardless of whether you’re a taxpayer, it’s still going to give you some tax relief. That’s an extra 20% added in on top of that contribution that could come from a third party.

For those in relationships, if one partner is working more while the other takes on more child rearing, contributing to the other person’s pension is a way of recognising that childcare is work (just unpaid and without a pension) – to make it fairer further down the line.

Couples should be “thinking about the financial situation for the family as a whole, rather than on an individual basis, and considering how they can make sure that one party is not detrimentally impacted in the long term – within the realms of it being supportable and budgeting carefully for it”, Harding says. “It’s probably not the most exciting thing to start thinking about, when children are small, but it’s absolutely paramount.”

5. If you come into some money, consider putting it in your pension

“There is a limit on the amount that you put into a pension in any one tax year, with a limit of £60,000 or 100% of UK net revenues. For most people, that’s 100% of their salary or income.

“Sometimes, there might be an inheritance, [and you’re] considering what to do with that windfall. It might be a redundancy, whatever it might be, thinking about whether or not that could be fed into a pension arrangement or alternative, you know, long term savings.”

Harding doesn’t advise to always put all of your money into pensions for the future – there are lots of saving options – but, “fundamentally, pensions are still really tax efficient”.

She explains: “The money that goes in, it’s a tax release on it, which is fantastic. While it’s there, there are no tax implications in terms of dividend tax, income tax, savings, interest or capital gains tax. So it just builds up this nice pot. Any gains you make there, it will be invested, so you attract further gains.

“Obviously, dependent on how it’s invested, there are periods of time when values do drop, but at the same time, over the long term, you would expect to see gains.”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.