The financial services sector needs to recognise the “hidden” factors stopping women from saving and planning for later life – rather than focusing on a perceived lack of female confidence in financial planning, according to a report.

The study, supported by wealth manager Evelyn Partners, said women are disproportionately affected by issues around people under-saving for their retirement.

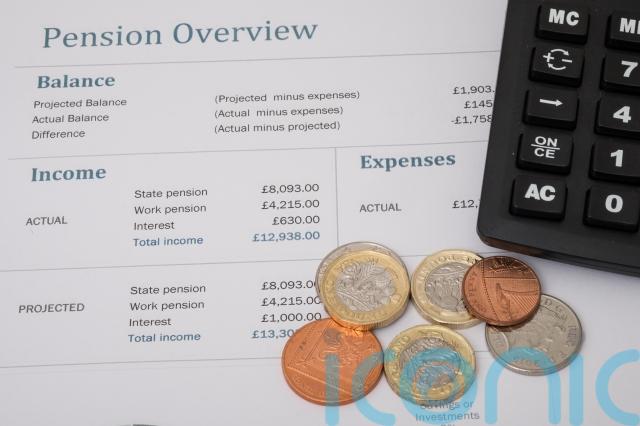

It said government figures indicate that men hold a median average amount of £75,000 in defined contribution (DC) pension wealth – the most common type of private workplace pension nowadays – by the age of 59, compared with an average of £19,000 for women.

The gender pay gap, with women often earning less, is partly behind the gender pension gap, along with employment gaps and part-time work due to child rearing, and the disproportionate burden on women of unpaid care for family members, the study said.

It added that as people live and work for longer, often in multiple careers, the financial system must evolve to accommodate these changes and prevent a “pensions timebomb”.

The report said: “Financial services often interpret women’s behaviour as caution, risk aversion or low confidence. When we place these

behaviours in context, a new picture emerges that more meaningfully guides supportive actions.”

The report said that “women have fewer opportunities to practise long-term financial decision-making because of gender inequalities in income, time, and uninterrupted work years”.

It argued that “the belief that men are more financially competent continues to influence women’s financial behaviour. ‘Confidence gaps’ reflect stereotypes, not capability”.

It also said that the ongoing work of anticipating, planning and caring for others “consumes the same mental resources needed for future planning. This reflects overload, rather than lack of engagement”.

Report author Emily Shipp, a psychologist and associate of the Edinburgh Futures Institute (EFI), said that a “confidence gap” narrative “has masked the real systemic, situational and social factors that result in the pensions gulf”.

“Mental load and time scarcity operate together. Women are more likely to carry the ongoing cognitive labour of anticipating and co-ordinating care, while also spending significantly more time on unpaid work. These pressures reduce both the mental bandwidth and the available time needed for sustained engagement with long-term financial planning,” she said.

“Historically, financial advice and pensions policy have centred on typically male, linear career trajectories and financial goals, rather than the multi-phase, care-interrupted lives many women navigate.

“Redesigning pensions policy and financial environments to better serve more varied priorities and life courses would better serve all genders as we move towards longer, multi-phase lives.”

With DC pensions, savers bear the risk of how much money they will end up with in retirement, depending on factors such as contributions and investment choices.

Those behind the study argued that this demands savers’ active engagement beyond a “set and forget” approach, which is often little understood and contributes to lower overall pensions wealth.

Emma Sterland, chief financial planning officer at Evelyn Partners, said: “We welcome this important new report from the University of Edinburgh’s Futures Institute. Its thought-provoking insights challenge entrenched narratives around women and wealth, shining a light on the complex structural barriers that women face as they build their financial security over a lifetime.”

The report was produced by the Compassion in Financial Services Hub (CFSH) at the Edinburgh Futures Institute.

Tobi Schneider, CFSH co-director, said: “This is an important report, recognising that society is changing, and that financial planning is becoming more and more necessary.

“With an ageing population, without action, we are sleepwalking into financial disaster for a large proportion of people.”

Helen Morrissey, head of retirement analysis, Hargreaves Lansdown, said moves to help women remain in the workforce are needed in order to see “meaningful change”.

She said: “This includes the provision of more flexible working practices such as working from home and the ability to fit work around caring responsibilities more easily.”

Jenny Ross, Which? Money editor, said: “Inadequate pension savings can have devastating consequences for quality of life in retirement, so it’s essential that more is done to address the systemic issues that prevent many women from building a pension pot to match their male peers.

“It’s time that we move away from the outdated assumption that women lack the confidence to handle financial planning, and instead look at tackling the practical and financial realities – from time away from work to take on caring responsibilities to the gender pay gap – that may prevent them from doing so.”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.