The average price tag on a home increased by £2,587 or 0.7% month-on-month in September, according to a property website.

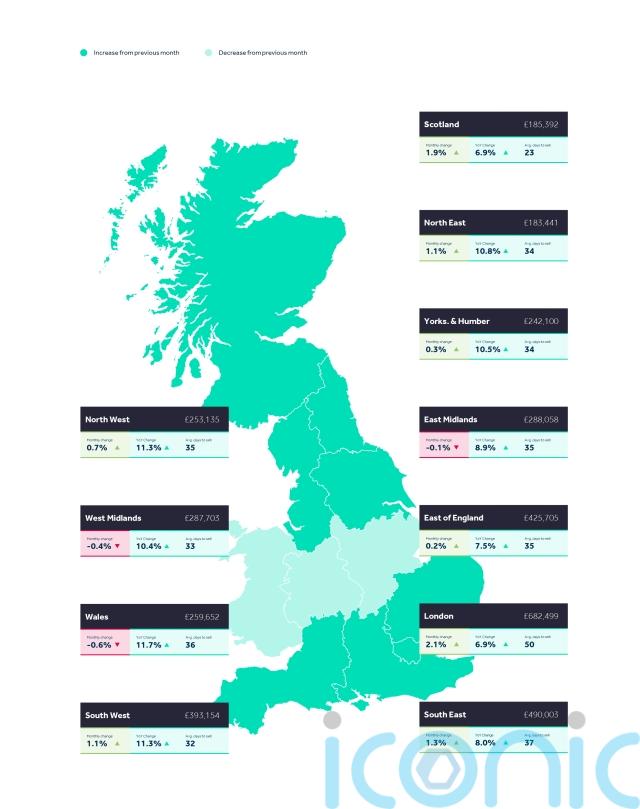

Across Britain, the average asking price of a property coming to market is £367,760.

Rightmove said the price increase is in line with the average September rise of 0.6% over the last 10 years.

It added that price growth this month is being driven predominantly by the middle and high-end market sectors.

On Thursday last week, the Bank of England base rate was increased from 1.75% to 2.25%, pushing up costs for some mortgage borrowers on variable rates.

Taking into account all of the recent Bank of England base rate hikes, a tracker mortgage is now about £210 per month more expensive on average than it was before the rate increases started last December, according to the UK Finance figures.

A standard variable rate (SVR) mortgage is now about £132 more expensive per month, according to UK Finance.

And in the mini-budget on Friday, the Government announced a stamp duty cut for home-movers and first-time buyers in England and Northern Ireland.

Rightmove said a 10% deposit on a first-time buyer type home is now 57% higher than 10 years ago, while average salaries have increased by 32% over the same time.

Rightmove’s housing expert Tim Bannister said while demand has been softening over the past few months, Friday’s announcement is likely to stimulate some more demand.

He said: “If it does lead to a big jump in prospective buyers competing for the constrained number of properties for sale then it could lead to some unseasonal price rises over the next few months.

“But because the change is permanent, and because of gathering headwinds such as rising mortgage rates, we expect to see a more gradual increase in demand compared with the surge when the temporary stamp duty holiday was announced in 2020.”

He said more first-time buyers who can afford it may make a jump to a bigger home as their first move.

Mr Bannister added: “With more buyer demand we would also expect that the current trend of more properties coming to market will continue, offering more choice for buyers.”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.