Average two and five-year fixed mortgage rates are continuing to climb above 6%, according to analysis.

Across all deposit sizes, the average two-year fixed-rate mortgage on the market on Monday had a rate of 6.31%, Moneyfacts.co.uk found.

The average five-year fixed rate was 6.19%.

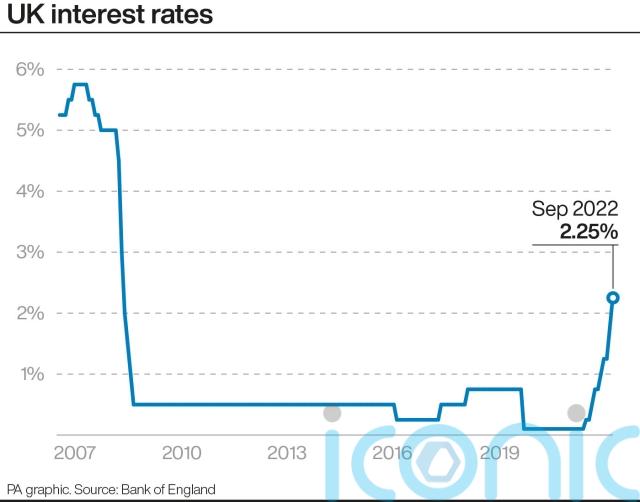

Two-year fixed rates breached 6% last week for the first time since 2008.

Five-year fixed mortgage rates hit 6% last week for the first time since 2010.

The choice of residential mortgage products is gradually improving, after many deals disappeared as lenders reacted to the market volatility stemming from the mini-budget.

There were 2,905 deals on the market on Monday, up from 2,533 on Friday.

However, there are still around 1,000 fewer mortgage products to choose from than there were on the day of the mini-budget, when the total was 3,961.

Many deals disappeared from the market amid the fallout from the recent mini-budget.

Bank of England base rate hikes in recent months, amid soaring inflation, have also had an impact.

The base rate is expected to rise further.

Last week Moneyfacts calculated that, based on Thursday’s rates, someone with a £200,000 mortgage paying it back over 25 years could end up paying around £5,000 per year more for a two-year fixed-rate deal than they would have done last December.

Rachel Springall, a finance expert at Moneyfacts.co.uk, said: “Mortgage interest rates are continuing to rise, so borrowers comparing fixed deals would be wise to seek advice to see what options are available to them.

“Mortgage products are starting to return after lenders temporarily withdrew deals amid interest rate uncertainty, but there is still much more room for improvement compared to the level of choice seen before the mini-budget.

“Consumers must carefully consider whether now is the right time to buy a home or remortgage, or to wait and see how things change in the coming weeks.”

As well as facing rising costs, rising mortgage rates could also make it harder for borrowers to pass lenders’ affordability checks, narrowing the options available to them.

Speaking earlier on Monday on ITV’s Good Morning Britain, consumer champion Martin Lewis, who was answering viewers’ questions, called for the creation of a “mortgage emergency plan”.

He said: “If you’re watching, regulator, Bank of England, Government, you need a mortgage emergency plan now, or there’s a ticking timebomb, that’s my opinion.”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.