Scottish Secretary Ian Murray has said there are disagreements in the agricultural sector over the so-called family farm tax, while insisting “we’re not going to change our minds”.

Attending the UK Government’s stall at the Royal Highland Show on Thursday, Mr Murray said the UK Government’s inheritance tax changes had not led to antagonism from farmers at the show.

The UK Government marquee at the sold-out agricultural fair showcased the “Brand Scotland” push to promote Scottish exports around the world.

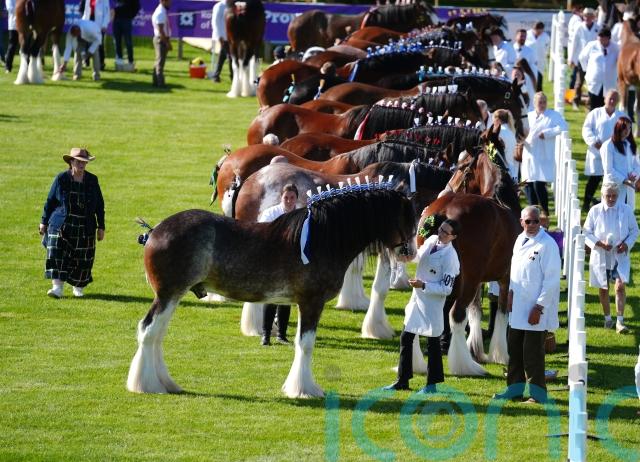

The packed-out fairground on the outskirts of Edinburgh basked in sunshine and temperatures upwards of 20C.

Speaking to the PA news agency, Mr Murray said he had been highlighting the new trade deals with India, the US and the EU to the agricultural community.

Asked if there had been any antagonism around the inheritance tax changes, he said “absolutely none at all”.

From April 2026, farmers who previously did not have to pay inheritance tax on their agricultural property face a new effective rate of 20%.

However the first £1 million of combined agricultural and business property, such as farmland, would not be taxed.

The plans have prompted a backlash from many in the agricultural sector.

Mr Murray said: “I’ve just met with the NFUS and the president there.

“We had a long discussion for 40 minutes on issues we’re helping them with.”

He said these included seasonal worker immigration issues.

The Scottish Secretary added: “They’re very, very happy about the SPS agreement and the EU trade deal.

“They want to advance that and go even further for obvious reasons.

“And then we had a small chat about inheritance tax as well.

“Of course it’s an issue where we’re not going to agree on everything.

“But the UK Government’s been pretty clear that we made that change in October, we’re not going to change our minds on that.

“So we’re going to have continued dialogue and discussions with the industry.”

The Treasury will consider alternative proposals, he said, but the tax changes make the system “fairer” and will stabilise the economy.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.