A two-year recession followed by “sluggish” growth lies ahead for the UK economy, an economic research institute has said.

The Fraser of Allander Institute published its commentary on the Bank of England’s economic forecasts on Thursday.

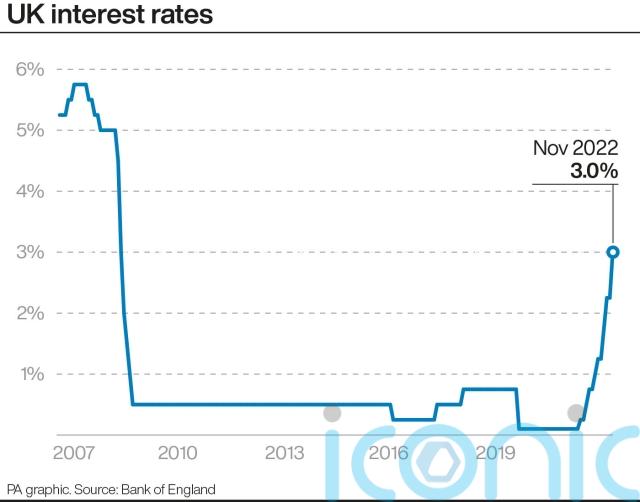

The central bank’s outlook was released alongside its decision to raise interest rates to 3% from 2.25%, meaning homeowners could face the biggest single shock on their mortgage bills since the 1980s.

Mairi Spowage, director of the Fraser of Allander Institute, said market expectations are that the base rate will peak at 5.25% after June next year.

Bank of England rates decision pushes rates up to 3% as expected and new forecasts predict a 2 year recessionhttps://t.co/GFAjEjW8tg

— Fraser of Allander Institute (@Strath_FAI) November 3, 2022

She said: “The forecasts do not paint a great picture of the economy.

“The Bank is now forecasting that the economy will contract for two years in total, from Q3 2022 to Q2 2024, with growth only returning in Q3 2024.

“Over the two-year period, the Bank is predicting that the economy will reduce in size by 2.4% in total.

“When the economy does return to growth, it looks pretty sluggish by historical standards.

“For 2025, the Bank are predicting that growth will be only 0.7%.”

Ms Spowage said the Bank assumed that UK Government intervention on energy bills would continue to suppress inflation beyond March next year.

Questioning this assumption, she said Government intervention may take the form of income support rather than a cap on bills.

She continued: “There is also clear uncertainty that the Bank continues to flag about the overall economic and fiscal situation.

“They have not (of course) taken account of any announcements that the UK Government may make in two weeks’ time, and flag this as a potential issue with their current forecast.”

Meanwhile, the charity Citizens Advice Scotland (CAS) warned mortgage costs are becoming a problem for many families.

CAS financial health spokesman Myles Fitt said: “The hits just keep on coming for people’s finances and household budgets.

“Today’s announcement will lead to higher mortgage payments for many along with more expensive debt repayments.

“And this is on top of increases in energy bills, petrol costs, food and other living costs while wages stagnate, so it is little wonder CAS are seeing increasing numbers of people who are just unable to cope.

“Our online advice page on mortgages had seen an increase of nearly 300% from the same period last year.

“Today’s announcement is going to make this problem a whole lot worse for homeowners across the country.”

A Scottish Government spokeswoman said: “The Scottish Government has over recent months repeatedly asked the UK Government to do more to support those most impacted by increasing inflation, interest rates and living costs.

“It is unacceptable that the actions of the UK Government, which have caused mortgages to be withdrawn and rates to increase, are exacerbating the cost-of-living crisis and causing significant damage to businesses and individuals.

“The Deputy First Minister this week published the emergency budget review (EBR), to prioritise spending and find savings to help those who need it most, reduce the burdens on business, and stimulate the Scottish economy through this cost-of-living crisis.

“We recognise the growing pressures on family budgets and have allocated almost £3 billion in this financial year which will contribute to helping mitigate the increased cost of living, including raising the Scottish Child Payment and extending eligibility, as well as providing access to free childcare, baby boxes, prescriptions, travel and social security payments not available anywhere else in the UK.

“The EBR will provide further assistance, including new payment break options to help protect those who have agreed to repay debt through the Debt Arrangement Scheme but face unexpected increases in the cost of living.”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.