A young professional who lost her £10,000 life savings to scammers posing as Revolut has said the fraudsters used an Evri parcel delivery to swindle her.

Sam Do, 31, was forced to live on rice and soy sauce, rent out her room and move in with her parents, when fraudsters tricked her into sending them her £10,170 life savings.

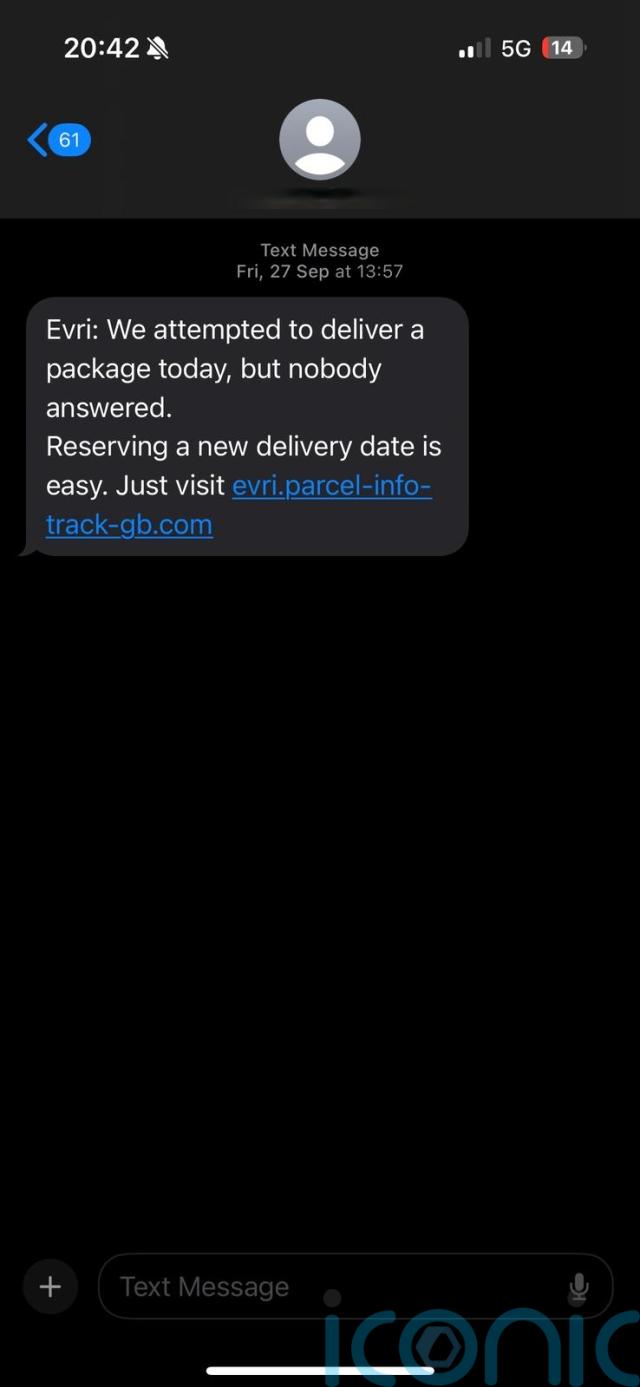

The sophisticated scheme started with a text message claiming that Sam, a London-based designer, needed to reschedule an Evri parcel delivery.

Days later, the scammer called Sam and manipulated her into sending them all her money, by posing as her bank American Express and then Revolut, claiming her account had been hacked.

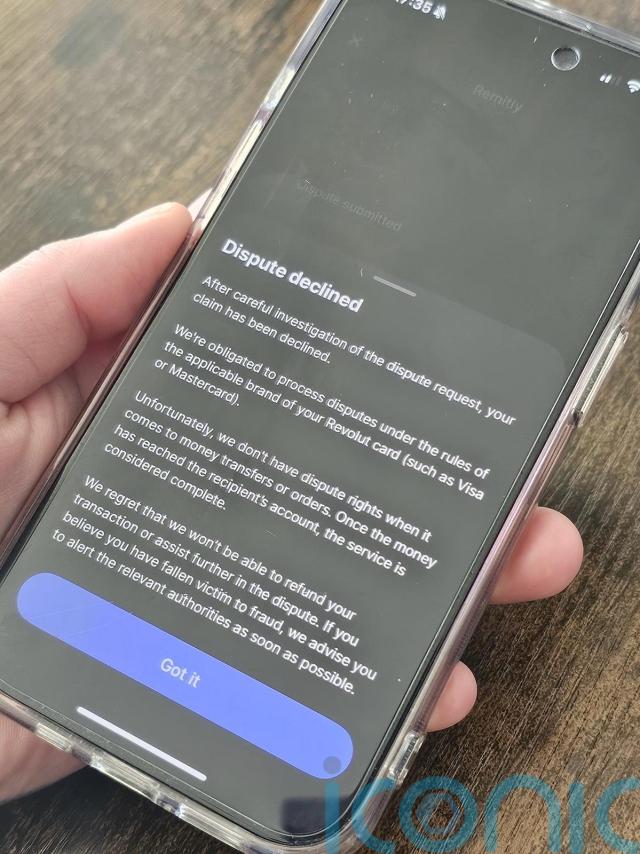

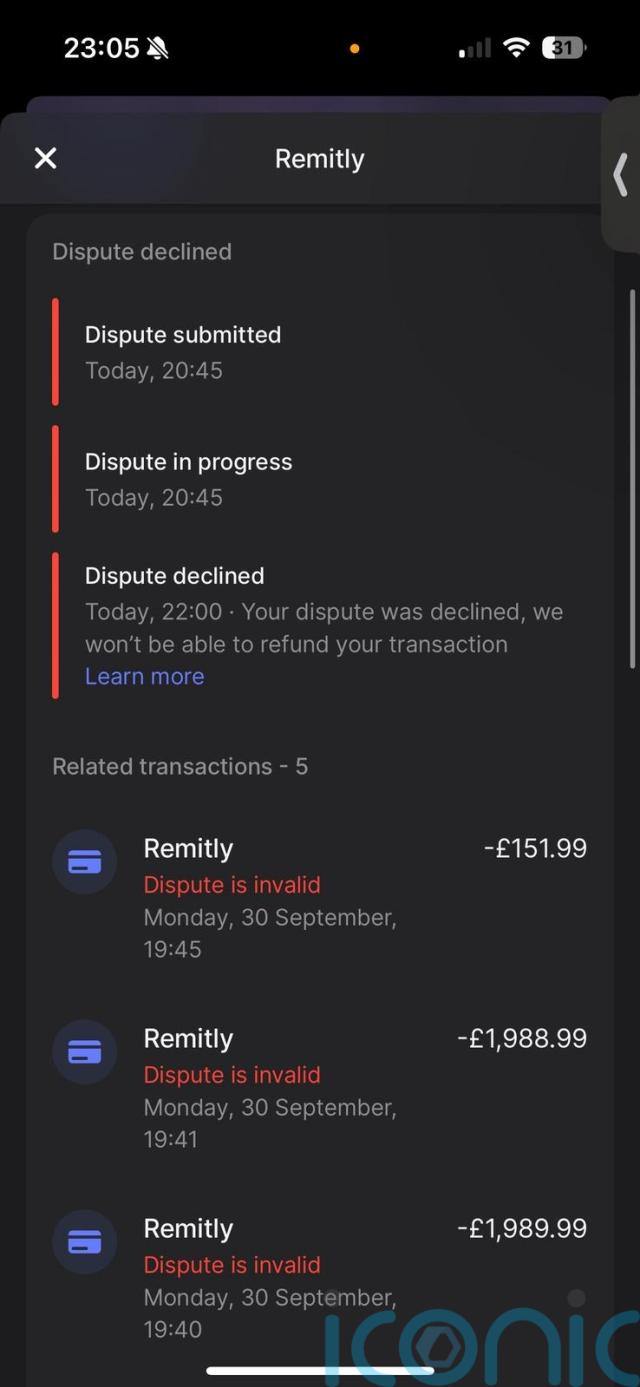

Six months later, Sam is still fighting to be reimbursed for her losses by Revolut, who she said demonstrated terrible customer service, poor online security and was “uninterested” in helping.

After raising a complaint with the Financial Ombudsman Service (FOS), she was offered 40% of what she lost and referred to a food bank as she pleaded for help, she said.

“There are many feelings in the world but this one felt worse than a gunshot to the head,” Sam told PA Real Life.

“All banks are better than Revolut – they have the worst customer service and the worst protection.

“I just feel helpless that all my money is gone without a trace.

“For four years, I had chosen to live in a cheap flat, sharing with three others and making sacrifices, so I could save to buy a house.

“But I should have enjoyed my life more since I have zero savings now, regardless.”

On September 27 2024, Sam received a text which claimed to be from the delivery company Evri, saying there was an attempt at delivery.

Sam, who was genuinely waiting for a parcel, clicked the link in the text and paid the £2.50 redelivery charge using her American Express (Amex) card details.

Three days later, she received a call from a man claiming to be from Amex who said that her card had been hacked.

“I thought back to the redelivery payment and everything was adding up at this point,” she said.

The scammer ran Sam through a series of security questions and provided her with a fake case number.

He then urged her to move all her money into her Revolut bank account, saying it was the most secure place for it.

A few minutes later, Sam received another call from a person claiming to be from Revolut.

“They went through the same process and asked for my case number so I really felt it was true,” she said.

Pretending to help secure Sam’s money in Revolut, the scammer tricked her into transferring it to an untraceable bank account, and then hung up the phone.

“It was so sudden and so shocking,” Sam said.

“When I saw the money had gone, I kept refreshing my phone and then went into a panic attack.”

With no caller ID, Sam was unable to return the call or trace the payment she had made.

Despite immediately contacting the police and her bank, she was told that the transactions were not suspicious and therefore she was not eligible for a refund.

“Nowadays there are so many scams and if you fall victim to this, it is extremely difficult to get your money back from Revolut,” she said.

“On top of this, I was instantly in debt as I was due to pay off £1,500 from my Amex.

“I just ate rice and soy sauce, rented out my room and went to live with my parents over Christmas, to try and make back money and gain some savings.”

In October, Sam raised a complaint with FOS which has so far only offered her a 40% refund.

“It felt like a punishment,” Sam added.

“The FOS investigator had treated me as though I were in the wrong, quizzing me on what I did and telling me what I should have done.

“I cried on the phone and pleaded with them but they just said they would put me as a priority case and referred me to the food bank and mental health support.”

Sam has returned to the flat she was renting with housemates, to be close to her work.

She is struggling to save money from scratch and is slowly starting to recover, with support and encouragement from family.

In November, FOS investigators recommended Sam share liability for the losses, which would have amounted to her receiving about a 40% reimbursement.

However, she chose to decline and escalate her complaint for further review in the hope of being fully refunded.

Four months later, Sam is yet to hear of any progress from FOS and is still waiting for an update.

“It’s endless – it could take two months or two years,” Sam said.

“I feel embarrassed because I never imagined being stupid enough to be scammed like this.

“I just want back what I lost and to prevent other people from going through this.”

A spokesperson for FOS said it cannot comment on individual cases.

Revolut said it will never phone customers without first confirming via its secure in-app chat, ask for sensitive information regarding your account or persuade you to transfer money between accounts.

A Revolut spokesperson said: “Unfortunately, we are unable to comment on individual cases subject to an ongoing Financial Ombudsman Service review.

“We are sorry to hear of any instance where our customers have been targeted by these ruthless and sophisticated criminals.

“Revolut is deeply concerned that large numbers of frauds are being enabled across the industry by criminals using fake and spoofed phone calls.

“If customers are in doubt, we encourage them to reach out to us via in-app chat for support.”

A spokesperson for Evri said: “We’re incredibly sorry to hear what happened to Ms Le and can only imagine the distress this has caused.

“Any attempt to scam our customers concerns us and we take fraudulent activity incredibly seriously.

“We work closely with a number of leading external cybersecurity partners and the UK Government’s National Cyber Security Centre to identify scams, alert our customers and remove these as quickly as possible.

“We have taken down almost 14,000 scam sites and fake social media profiles impersonating Evri in the last 12 months.

“We would never request payment for redelivery from our customers, and would urge all customers to report suspicious activity to our dedicated mailbox, phishing@evri.com, or to the Government’s own anti-phishing services at 7726, or report@phishing.gov.uk”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.