Food inflation will rise and remain above 5% well into next year if the retail industry is hit by further tax rises at the autumn Budget, leaders have warned.

The British Retail Consortium (BRC) said it is concerned that around 4,000 large shops could see their business rates rise if they are included in the Government’s new surtax for properties with a rateable value over £500,000, and that could lead to price rises for consumers.

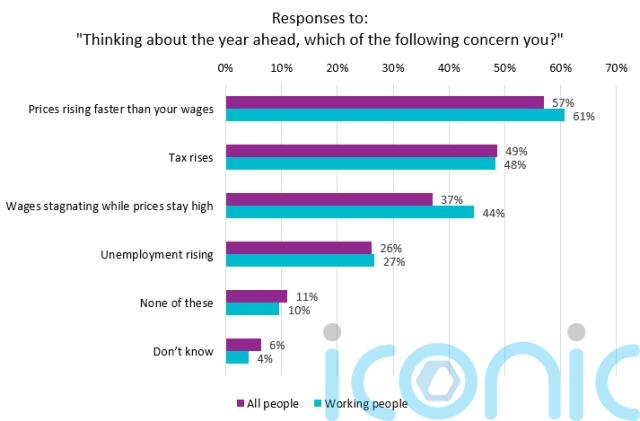

A new survey by the BRC found that people’s biggest concern was “prices rising faster than wages”, with 57% of respondents agreeing – rising to 61% of working people.

This was higher than concerns around tax rises (49%) and rising unemployment (26%).

Latest ONS figures put inflation at 3.8%, almost double the Bank of England’s target of 2%.

This was even higher for food inflation, which rose to 4.9%, the highest level since the cost-of-living crisis in 2022/23.

Retail price inflation has been rising steadily over the last year, which the BRC said had been accelerated by the impact of the previous budget – which significantly increased employment costs, as well as introducing a new packaging tax on retail businesses.

Last week, the Bank of England held off from an interest rate cut amid fears that rising food prices were putting upwards pressure on headline inflation.

BRC chief executive Helen Dickinson said: “The Government risks losing the battle against inflation and working families are understandably worried.

“With many people barely recovering from the last cost-of-living crisis, the Chancellor will want to protect households and enable retailers to continue doing everything they can to hold back prices.

“The Treasury is currently finalising its plans to support the high street, including a much-needed reduction in business rates for retail, hospitality and leisure premises. However, the biggest risk to food prices would be to include large shops – including supermarkets – in the new surtax on large properties.

“This would effectively be robbing Peter to pay Paul, increasing costs on these businesses even further and forcing them to raise the prices paid by customers.

“Removing all shops from the surtax can be done without any cost to the taxpayer, and would demonstrate the Chancellor’s commitment to bring down inflation.”

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.