Economists have urged Rachel Reeves to prioritise difficult political decisions in the Budget that they said would strengthen financial markets’ confidence in the UK and bring down the cost of borrowing.

Responding to the Chancellor’s speech on Tuesday, Nick Williams, former economic policy adviser to Sir Keir Starmer, said investors would welcome her priorities and consistent messaging.

The Chancellor put the country on notice that tax rises were coming in her Budget, saying during a speech on Tuesday that “each of us must do our bit”.

The Resolution Foundation, which has close ties to Labour, said Ms Reeves should aim to double her fiscal headroom to reassure markets that the Government was focused on economic stability.

This would result in the buffer against unexpected changes in the economic headwinds being increased to £20 billion.

Hiking income tax would be the “best option” for raising cash, the think tank said, but suggested it should be offset by a 2p cut to employee national insurance, which would “raise £6 billion overall while protecting most workers from this tax rise”.

Ms Reeves declined, in her speech on Tuesday, to recommit to Labour’s manifesto commitments not to raise income tax, national insurance or VAT, saying “we will all have to contribute”.

The Resolution Foundation said its tax proposal “would send a clear message to markets that she is serious about fixing the public finances, which in turn should reduce medium-term borrowing costs and make future fiscal events less fraught”.

Speaking at a Resolution event following the Chancellor’s speech, Mr Williams referenced efforts to stabilise public sector investment and reforms to the pensions market as factors that would result in the Government being viewed as having “the right sort of growth strategy”.

He added that the high cost of borrowing had been a “distraction from what is otherwise a quite a positive, proactive agenda”.

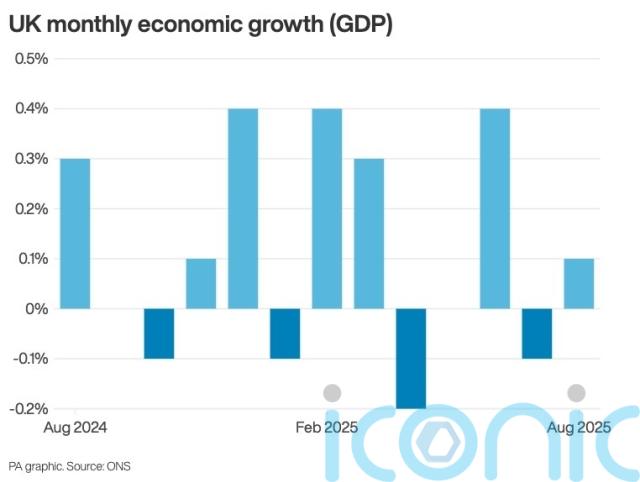

But he acknowledged there was an “uncertain picture” that posed a political problem for the Chancellor when she was trying to persuade the public that everyone must make a contribution.

Mr Williams said: “It is really good, given all the confusion, that the Chancellor started to roll the pitch, and she has been communicating quite consistently in the road to this Budget.

“She had a lot to say that people in the markets who would be watching, looking out for signs, would say are the right things: bearing down on inflation, raising the headroom, the broad base of contribution, I think, is also important because it talks to that credibility point.

“Getting to 15, 17, 18 billion of headroom is all well and good, but the market has to believe that the revenue raises you are going to get are credible as well.”

He added: “You have got to build the headroom so the market knows that there is not going to be this constant speculation about what is going to happen if we see gilt rates fluctuate a little bit.”

Mr Williams said the approach could perpetuate “a virtuous circle” in which “borrowing goes down, headroom starts building itself, and we get into a political cycle where the hard work is done”.

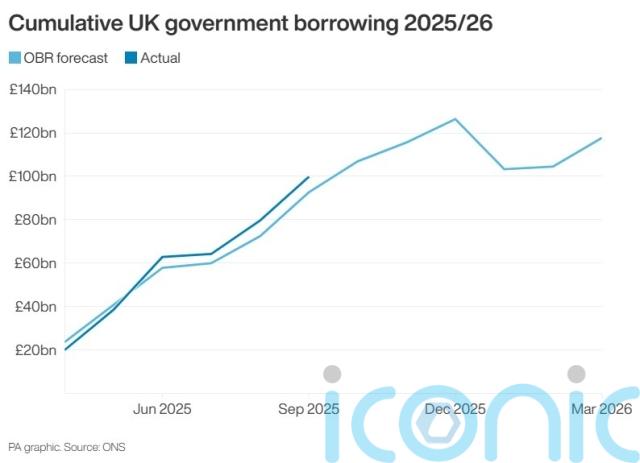

On Tuesday, Britain’s long-term borrowing costs edged lower after the Chancellor reiterated an “ironclad” commitment to her fiscal rules, but the pound came under further pressure as she set the stage for an income tax hike.

Yields on UK government bonds, also known as gilts, fell up to six basis points to 4.38%, while the 30-year yield dropped to its lowest level since April at 5.15% at one stage.

The UK has endured high borrowing costs due to persistent inflation, large government debt and a reliance on foreign investors who seek higher returns due to perceived risks.

Also speaking at the event, Stephanie Flanders, head of Bloomberg Economics, said there was support and a recognition among investors that the Government had done “important things to put the economy on a better path”.

But she said the UK had not yet provided short-term certainty “around financing and the commitment of the Government to taking difficult decisions”.

“There has been this endless debate about what the next tax rise could be. All of that has been very corrosive, not just politically for the Government, but also in terms of the standing of the Government,” Ms Flanders said.

“It suggests you could get significant benefit from proving to the markets, showing that you are willing to do a lot to have reduced uncertainty going forward.

“Focus on having much larger fiscal headroom, that you are willing to do politically difficult things even if some people say that you are breaking your manifesto pledges with significant tax increases.”

Ms Flanders said a one percentage point reduction in the interest the Government was paying reduced Government debt interest by £17 billion.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.