Britain’s jobless rate has surged to its highest level for more than four-and-a-half years and wage growth has slowed further as the labour market continues to weaken, according to official figures.

Latest data from the Office for National Statistics (ONS) showed a worse-than-expected rise in the rate of unemployment, to 5% in the three months to September, up from 4.8% in the three months to August and the highest level since early 2021.

This was more than the 4.9% expected by most analysts, according to Pantheon Macroeconomics.

The ONS said average regular wage growth also pulled back again, to 4.6% in the three months to September, down from 4.7% in the previous three months.

Wage growth is now the lowest seen since April 2022.

Earnings are still outstripping inflation, although by a smaller margin, with real wages 0.8% higher after taking Consumer Prices Index (CPI) inflation into account, down from 0.9% in the previous three months.

In further evidence of a tough jobs market, the ONS estimated the number of workers on UK payrolls fell by 32,000 during October to 30.3 million, following an upwardly revised 32,000 drop the previous month, although the numbers are subject to further revisions.

This was the largest two-month drop since late 2020, economists said.

ONS director of economic statistics Liz McKeown said: “Taken together these figures point to a weakening labour market.

“The number of people on payroll is falling, with revised tax data now showing falls in most of the last 12 months.

“Meanwhile the unemployment rate is up in the latest quarter to a post-pandemic high.”

There was one bright spot in the data, with vacancies rising by 2,000 or 0.2% to 723,000 in the three months to October.

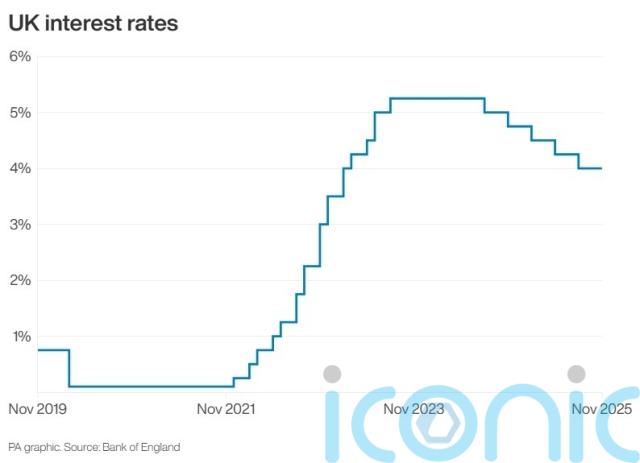

Experts said the cooling jobs market suggests the worries over what might be to come in the November 26 Budget were adding to hiring reticence among firms, but reinforces the case for an interest rate cut next month.

The pound slipped back, down 0.3% to 1.31 US dollars and 0.4% lower at 1.14 euros, as financial markets increasingly bet on a year-end rate cut.

Martin Beck, chief economist at WPI Strategy, said: “Signs of renewed weakness in the UK labour market suggest the real economy is starting to feel the chill of Budget tax uncertainty.

“With pay growth slowing further, the data strengthen the case for the Bank of England to cut interest rates next month.”

He warned that the “prospect of new tax rises in the upcoming Budget poses further risks to employment, particularly if the Chancellor again looks to raise taxes on businesses”.

Mr Beck added: “But this time, Rachel Reeves is more likely to target earners rather than employers.”

Investec Economics said the jobs data and easing in wage growth – both of which are being watched carefully by the Bank of England – made a December cut in rates from 4% to 3.75% more likely.

“What will be key however to the December debate, and the path for rates looking further forward, are the two CPI reports, and of course the details of the Budget, which we will receive before the December 18 rate announcement,” said Investec economist Ellie Henderson.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.