Chancellor Rachel Reeves has announced tax rises amounting to £26 billion after a downgrade in forecast economic growth.

More than 1.7 million people will face paying more income tax after thresholds were frozen.

Ms Reeves acknowledged the freeze in tax thresholds would hit “working people” – the group Labour had promised to protect – but she was “asking everyone to make a contribution”.

In an unprecedented blunder, full details of the Chancellor’s plans were published by the Office for Budget Responsibility more than half an hour before she stood up in the Commons chamber.

Tory leader Kemi Badenoch said the Budget was a “total humiliation” for Rachel Reeves and “if she had any decency she would resign”.

2.25pm

Our live coverage is now ending, thank you for joining us on a remarkable day in the House of Commons.

2.23pm

Here’s how the tax burden as a percentage of GDP is forecast to grow

2.20pm

Here is a round-up of the tax rises and cost-of-living measures the Chancellor announced at the Budget.

– Economic growth

The Office for Budget Responsibility (OBR) has increased its forecast for economic growth this year from 1% to 1.5% but downgraded its forecasts for the following four years.

Growth has been downgraded in 2026 from 1.9% to 1.4%, in 2027 from 1.8% to 1.5%, in 2028 from 1.7% to 1.5% and in 2029 from 1.8% to 1.5%.

– Fiscal headroom

The amount of headroom the Chancellor has against economic shocks has been raised by tax hikes in the Budget, according to the OBR.

The leeway the Government has against the Chancellor’s day-to-day spending rule will widen to £22 billion in 2029-30, £12 billion more than in March, the Budget watchdog said.

In future, the Chancellor will ask the OBR to assess whether she is meeting her fiscal rules just once a year, in the autumn budget, rather than twice a year.

– Income tax thresholds

The Chancellor will extend a freeze of income tax thresholds until 2030, a move previously described as a “stealth” tax rise, but which Ms Reeves billed as “asking everyone to make a contribution”.

This will drag more people into paying the tax for the first time, and others into paying a higher rate as wages rise.

The OBR said the freeze in tax thresholds would result in 780,000 more basic-rate, 920,000 more higher-rate and 4,000 more additional-rate income tax payers in 2029/30, and estimated it will raise about £7.6 billion in 2029-30.

– Pensions and salary sacrifices

Ms Reeves will limit the amount of money people can put into their private pension pot, through a scheme called a salary sacrifice, before it incurs tax.

Anything above the new £2,000 cap will incur national insurance contributions from 2029, a move which has been estimated to raise £4.7 billion in 2029-30 and £2.6 billion in 2030-31. At the moment there is no limit.

– Property taxes

A “high value council tax surcharge” will be introduced on properties worth more than £2 million, a so-called mansion tax.

Four price bands will be introduced, rising from £2,500 for a property valued between £2 million and £2.5 million, to £7,500 for a property valued at £5 million or more, all uprated by inflation each year.

– Business taxes

The Chancellor said she would introduce “permanently lower” business rates for more than 750,000 retail hospitality and leisure properties.

The rates, which Ms Reeves said would be the “lowest rates since 1991”, will be paid for through higher rates on properties worth more than £500,000, including the warehouses used by “online giants”.

– Electric vehicles tax

Drivers of electric vehicles will have to pay 3p per mile they drive under a new tax introduced by the Chancellor, which is expected to rise annually with inflation.

– Gambling tax

Ms Reeves will increase the levy on “remote gaming” such as online gambling from 21% to 40% next year, in a bid to deter people from a form of gambling associated with the “highest levels of harm”.

She will also abolish bingo duty in April 2026.

– Two-child benefit cap scrapped

The two-child cap is being scrapped from April and is expected to lift “450,000 children out of poverty”, the Chancellor said.

The cap has prevented parents from claiming universal credit or tax credits for more than their first two children.

The move is estimated to cost £3 billion by 2029-30, according to the OBR.

– Travel costs

A cut to fuel duty will be extended as a means of holding down the price of petrol at the pump.

The tax has been held at 57.95p since 2011, but the effective rate paid by drivers since 2022 has been 52.95p as a result of a “temporary” 5p cut.

Rail fares have also been frozen for a year.

The Motability scheme, which helps disabled people with the cost of a car, will meanwhile no longer offer “luxury vehicles”, Ms Reeves said.

– Isa reforms

The annual cash Isa limit will be reduced to £12,000. The aim of reducing the limit from £20,000 is to encourage more people to invest their money in stocks and shares instead.

– Energy bills

The Chancellor said she was taking action to get energy bills down and cut the cost of living, with an average of £150 cut from the average household bill from next year.

Ms Reeves said she would do this by scrapping an “eco scheme” introduced by the Tories in government, which she claimed had cost households £1.7 billion a year on their bills.

2.06pm

Government borrowing costs eased back and the pound strengthened after an initial sell-off sparked by the early release of Office for Budget Responsibility forecasts.

Having initially jumped higher, yields on 30-year UK Government bonds, which are also known as gilts, later stood three basis points lower at 5.3% while yields on 10-year bonds were also three basis points down at 4.48%.

The yield moves counter to the price of bonds, meaning that prices rise when yields fall.

Experts said the market was relieved by forecasts for a larger fiscal buffer and a credible path to lower government borrowing.

The pound also rebounded after initial weakness, later standing 0.2% higher at 1.32 US dollars and 0.4% higher at 1.14 euros.

2pm

Responding to the Budget, Conservative Party leader Kemi Badenoch said it was a “total humiliation” and that Rachel Reeves should resign.

Mrs Badenoch congratulated the Chancellor and said: “I hope she enjoyed it, because it really should be her last.”

The Tory leader continued: “It’s a total humiliation. Last year she put up taxes by £40 billion, the biggest tax rate in British history.

“She promised that she wouldn’t be back for more. She swore it was a one-off. She told everyone that from now on it would be stability, and she would pay for everything with growth. Today she has broken every single one of those promises. If she had any decency, she would resign.

“At the last budget she said she was proud to be the country’s first-ever female Chancellor, after this Budget, she will go down as the country’s worst-ever Chancellor.”

Labour MPs responded by laughing at the accusation, with shouts towards the Conservative benches about former prime minister Liz Truss and chancellor Kwasi Kwarteng.

Chief whip Jonathan Reynolds was reprimanded by deputy speaker Nus Ghani for clapping.

1.56pm

Rachel Reeves announced an extension to the temporary 5p fuel duty cut until September next year, alongside a rail fare freeze.

She said: “Under current plans, the temporary 5p cuts of fuel duty that was introduced during the pandemic will come to an end in April and fuel duty will be updated in line with inflation.

“But I know that the cost of travelling to and from work is still too expensive.

“And so I’m extending the 5p cuts until September 2026.”

1.54pm

On energy bills, the Chancellor said: “The Conservatives’ ECO (energy company obligation) scheme was presented as a plan to tackle fuel poverty.

“It costs households £1.7 billion a year on their bills, and for 97% of families in fuel poverty the scheme has cost them more than it has saved. It is a failed scheme.

“So, I am scrapping that scheme along with taking other legacy costs off bills.

“And as a result, I can tell you today that for every family we are keeping our promise to get energy bills down and cut the cost of living with £150 cut from the average household energy bill from April.”

1.48pm

Electric vehicle (EV) users will pay 3p per mile in a new tax, Rachel Reeves confirmed.

The Chancellor told the Commons: “I will ensure that drivers are taxed according to how much they drive and not just the type of car they own by introducing electric vehicle excise duty on electric cars.

“This will be payable each year alongside vehicle excise duty at 3p per mile for electric cars and 1.5p for plug-in hybrids, helping us to double road maintenance funding in England over the course of this Parliament.”

Additionally, £200 million will go towards the rollout of EV charging, Ms Reeves said, and the threshold for the expensive car supplement on EVs will increase to £50,000, which she said would save more than one million motorists £440 a year.

1.47pm

1.44pm

Chancellor Rachel Reeves said there will be a £150 cut to the average household energy bill from April next year.

1.42pm

Chancellor Rachel Reeves confirmed the two-child benefit cap will be lifted, telling the Commons: “We on this side of the House do not believe that the solution to a broken welfare system is to punish the most vulnerable children.”

1.40pm

Here’s a visual view of how the freeze on income tax thresholds has been extended to 2030/31

1.38pm

Capital gains tax relief on business sales made to employee ownership trusts will be reduced from 100% to 50%, Chancellor Rachel Reeves announced.

1.37pm

Salary sacrifice into pensions above £2,000 will be taxed from 2029, Chancellor Rachel Reeves said.

She told the Commons: “I am introducing a £2,000 cap on salary sacrifice into a pension, with contributions above that taxed in the same way as other employee pension contributions.

“That is a pragmatic step so that people, especially on low and middle incomes, can continue to use salary sacrifice for their pension without paying any more tax than they do now.

“And to give individuals and employers time to adjust to these new arrangements, these changes will come into effect in 2029.”

1.35pm

Rachel Reeves confirmed income tax and equivalent national insurance thresholds will be frozen at their current levels into the 2030s.

The Chancellor told the Commons: “I am asking everyone to make a contribution.”

Ms Reeves said: “Today, I will maintain all income tax and equivalent national insurance thresholds at their current level for a further three years from 2028.”

Turning to taxes affecting pensions, the Chancellor said she would ensure “that people only in receipt of the basic or new state pension do not have to pay small amounts of tax through simple assessment from April 2027”.

She continued: “I will also keep the plan two student loan repayments threshold at its 2026/27 level for three years.”

1.31pm

Taxes are rising on remote gaming from 21% to 40%, and on online betting from 15% to 25%, while there are no changes for in-person gambling or horse racing, and bingo duty is being abolished in Rachel Reeves’ Budget.

1.29pm

The Office for Budget Responsibility has apologised for the leak of its forecasts before the Budget, which it blamed on a “technical error”.

1.28pm

Chancellor Rachel Reeves set out reforms to the Motability system, removing access to “luxury vehicles”.

She said: “The Motability scheme was set up to protect the most vulnerable, not to subsidise the lease on a Mercedes Benz, and so, I am making reforms that will reduce generous taxpayer subsidies.

“And Motability have confirmed that they will remove luxury vehicles from their scheme, getting the scheme back to its original purpose of offering cost-effective leases to disabled people.”

1.27pm

People living abroad will no longer have access to the class two voluntary national insurance contributions system, in a crackdown on state pensions paid to overseas claimants.

Chancellor Rachel Reeves told the Commons: “Taxpayers’ money should not be spent on pensions for people abroad who only lived here for a couple of years and may never have paid a penny in tax.

“The Conservatives allowed thousands of people living abroad to buy their way into the state pension for as little as £3.50 a week, debasing the purpose of our pension system.

“And so I will abolish access to class two voluntary national insurance contributions for people living abroad, increasing the time that someone has to live or work in Britain to 10 years and increasing the contributions they must pay.”

1.26pm

Training for under-25 apprenticeships will be “completely free for small and medium-sized enterprises”, the Chancellor said.

1.24pm

1.22pm

Rachel Reeves said she is “asking everyone to make a contribution” by freezing tax thresholds, as she acknowledged the move would break previous Labour promises because it “is a decision that will affect working people”.

1.20pm

Tax rates on property, savings and dividend income will rise by two percentage points, Chancellor Rachel Reeves said.

1.19pm

Here’s a breakdown of the forecast spending on different types of welfare:

1.18pm

All payments from the Infected Blood scheme will be exempt from inheritance tax, Rachel Reeves said.

The Chancellor also committed to transferring the Investment Reserve Fund of the British Coal Staff Superannuation Scheme to its members.

1.16pm

On the NHS, Rachel Reeves told the Commons: “Today I’m announcing a £300 million investment in technology to improve patient service and 250 new neighbourhood health centres, expanding more services into communities so that people can receive treatment outside of hospitals and get better, faster care where they live with over 100 to be delivered by 2030 including in Birmingham, Truro and Southall.

“The Labour Party founded our NHS and we are renewing our NHS.”

1.12pm

Chancellor Rachel Reeves said the Labour Government is “getting debt down”.

She told the Commons: “Despite the challenges we face on productivity, the path of our deficit reduction remains broadly the same as in the spring – public sector net borrowing is due to be £112.1 billion or 3.5% of GDP in 2026/27, 3.0% in 27/28, 2.6% in 28/29, 1.9% in 29/30 and 1.9% in 30/31 – ending at £67.2 billion, translating into an increase in the net cash requirement next year of £4.2 billion, taking the total to £133.3 billion.

“According to the IMF, we are due to reduce borrowing more over the rest of this Parliament than any other G7 economy.”

1.11pm

Chancellor Rachel Reeves said she will find a further £4.9 billion in efficiency savings by 2031, including by “getting rid of police and crime commissioners, cutting the cost of politics and local government” and “selling government assets that we no longer have any use for”.

1.10pm

1.07pm

MPs were told Northern Ireland will receive £370 million through the Barnett formula, while Wales will get £505 million, and £820 million will be allocated to Scotland.

Low-carbon technologies in Grangemouth, where an oil refinery closed earlier this year, will receive £14 million backing, Rachel Reeves said as she set out her Budget pitch for Scottish industry.

Turning to Northern Ireland, Ms Reeves unveiled plans for £17 million “to support businesses and strengthen the UK internal market and backing advanced manufacturing through the Northern Ireland enhanced investment zone”.

1.04pm

Chancellor Rachel Reeves has said she will ask the Office for Budget Responsibility to assess whether she is meeting her fiscal rules just once a year, in the autumn budget, rather than twice a year.

1.02pm

A comparison of the Government’s projected spending on welfare from different forecasts has been published:

1pm

Inflation and unemployment are set to be higher than expected in 2025 and 2026, according to leaked forecasts by the Office for Budget Responsibility.

It came as the UK’s official forecaster also reported that economic growth will be weaker than expected from 2026 to the end of the current Labour government, as the tax burden on the economy continues to rise.

Nevertheless, the OBR said the UK economy is set to grow by 1.5% in 2025, in an upgrade from its previous prediction of 1% from its March outlook.

However, this is set to slow to 1.4% next year. The forecaster had previously predicted a reading of 1.9% for the year.

Meanwhile, the OBR said UK inflation is set to be 3.5% for this year, up from a previous projection of 3.2%.

It also increased its inflation prediction for next year to 2.5% from 2.1%, although it still expects this to slow to the 2% target level by 2027.

The OBR also highlighted that the tax burden on the economy will hit record levels by the end of the Labour government.

The UK’s tax-to-GDP ration is on track to strike a record high of 38.3% of GDP by 2030-31.

12.53pm

Rachel Reeves announced that £8,000 of the £20,000 tax-free ISA allowance must be invested in stocks and shares, capping the annual cash ISA allowance at £12,000, except for those who are over 65.

12.52pm

12.50pm

Chancellor Rachel Reeves insisted forecasts were “the Tories’ legacy, not Britain’s destiny” after the Office for Budget Responsibility lowered its expectations for productivity growth by 0.3 percentage points.

12.48pm

The amount of headroom against the Government’s targets will double to £21.7 billion, Chancellor Rachel Reeves told the Commons.

She told MPs: “I said there would be no return to austerity, and I meant it.

“This Budget will maintain our investment in our economy and our National Health Service. I said I would cut the cost of living, and I meant it. This Budget will bring down inflation and provide immediate relief for families. I said that I would cut debt and borrowing, and I meant it.

“Because of this Budget, borrowing will fall as a share of GDP in every year of the forecast, our Net Financial Debt will be lower by the end of the forecast than it is today, and I will more than double the headroom against our stability rule to £21.7 billion – meeting our stability rule and meeting it a year early.

“These are my choices. Not austerity. Not reckless borrowing. Not turning a blind eye to unfairness. My choice is a Budget for fair taxes, strong public services, and a stable economy. That is the Labour choice.”

12.47pm

Chancellor Rachel Reeves is now delivering her Budget in the House of Commons.

She said that because of her Budget “borrowing will fall as a share of GDP in every year of this forecast” and the amount of headroom against the Government’s targets will double to £21.7 billion, “meeting our stability rule and meeting it a year early”.

12.37pm

Chancellor Rachel Reeves said the unprecedented pre-Budget publication of the Office for Budget Responsibility’s document was “deeply disappointing and a serious error on their part”.

12.36pm

Drivers of battery electric cars will be hit by a 3p-per-mile tax from April 2028, with the charge to rise annually with inflation, according to the OBR.

12.27pm

National Insurance will be charged on salary-sacrificed pension contributions above an annual £2,000 threshold from April 2029, raising £4.7 billion, the Office for Budget Responsibility said.

12.28pm

The OBR has released figures on how the CPI inflation measure is expected to change between now and 2029

12.24pm

The Office for Budget Responsibility has apologised and launched an investigation after its economic and fiscal outlook document was published early ahead of the Budget, describing it as a “technical error”.

The OBR said in a statement: “A link to our economic and fiscal outlook document went live on our website too early this morning. It has been removed.

“We apologise for this technical error and have initiated an investigation into how this happened.

“We will be reporting to our oversight board, the Treasury, and the Commons Treasury Committee on how this happened, and we will make sure this does not happen again.

“Our economic and fiscal outlook and supporting documents will be released when the Chancellor has finished her speech.”

12.21pm

A high-value council tax surcharge on properties worth over £2 million is set to raise £0.4 billion in 2029-30, according to the OBR.

12.21pm

Debt is set to rise from 95% of GDP this year to 96.1% by the end of the decade, according to Office for Budget Responsibility forecasts.

The amount of headroom the Government has against its borrowing rules will widen to £22 billion in 2029-30, according to the latest forecast from the OBR, which is £12 billion more than in March.

12.18pm

This interactive graphic shows the Budget 2025 GDP forecast

12.17pm

The amount of headroom the Government has against its borrowing rules will widen to £22 billion in 2029-30, according to the latest forecast from the OBR, which is £12 billion more than in March.

12.16pm

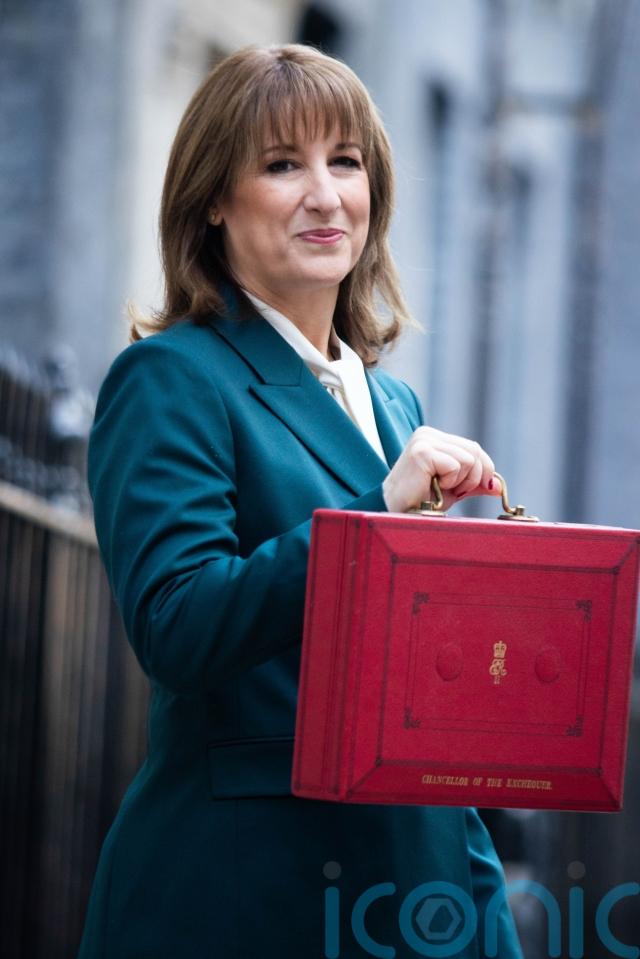

Here is a screen grab taken from the website of the Office for Budget Responsibility showing their economic and fiscal document, which was published before Chancellor Rachel Reeves delivers her Budget, despite normally releasing it afterwards by convention.

12.14pm

Rachel Reeves will retain the 5p cut in fuel duty until September 2026, when it will be reversed through a staggered approach, according to the OBR.

12.14pm

The OBR said the freeze in tax thresholds would result in 780,000 more basic-rate, 920,000 more higher-rate and 4,000 more additional-rate income tax payers in 2029/30.

12.10pm

The two-child benefit cap is being removed at an estimated cost of £3 billion by 2029-30, according to the Office for Budget Responsibility.

12.06pm

Rachel Reeves’ Budget will extend the existing freezes to personal tax thresholds for another three years until 2030-31, the Office for Budget Responsibility’s published forecast document shows.

12.04pm

The Office for Budget Responsibility has increased its forecast for economic growth this year from 1% to 1.5% but downgraded its forecasts for the following four years.

12.03pm

The Government’s independent spending watchdog the Office for Budget Responsibility has published its economic and fiscal document before Chancellor Rachel Reeves delivers her Budget, despite normally releasing it afterwards by convention.

12.02pm

The Metropolitan Police said they had made “several arrests” after farmers drove their tractors to a Budget day protest in central London in defiance of restrictions on bringing agricultural machinery to the demonstration.

Anyone breaching conditions by bringing vehicles, including tractors or agricultural vehicles, to today’s farmers protest will be asked by officers to leave.

If they refuse to comply with the conditions, officers will have to make arrests for offences under the Public Order Act. https://t.co/qdbOhgXSPm

— Metropolitan Police (@metpoliceuk) November 26, 2025

12pm

Farmers brought their tractors to London to protest over a number of measures, including inheritance tax changes.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.