Wall Street’s worst crisis since Covid slammed into a higher, scarier gear on Friday.

The S&P 500 lost 6% after China matched US President Donald Trump’s big raise in tariffs announced earlier this week.

The move increased the stakes in a trade war that could end with a recession that hurts everyone.

Not even a better-than-expected report on the US job market, which is usually the economic highlight of each month, was enough to stop the slide.

The drop closed the worst week for the S&P 500 since March 2020, when the pandemic crashed the economy.

The Dow Jones Industrial Average plunged 2,231 points, or 5.5% on Friday, and the Nasdaq composite tumbled 5.8% to pull more than 20% below its record set in December.

So far there have been few, if any, winners in financial markets from the trade war. Stocks for all but 12 of the 500 companies that make up the S&P 500 index fell on Friday.

The price of crude oil tumbled to its lowest level since 2021. Other basic building blocks for economic growth, such as copper, also saw prices slide on worries the trade war will weaken the global economy.

China’s response to US tariffs caused an immediate acceleration of losses in markets worldwide. The Commerce Ministry in Beijing said it would respond to the 34% tariffs imposed by the US on imports from China with its own 34% tariff on imports of all US products beginning on April 10.

The United States and China are the world’s two largest economies.

Markets briefly recovered some of their losses after the release of Friday morning’s US jobs report, which said employers accelerated their hiring by more last month than economists expected.

It is the latest signal that the US jobs market has remained relatively solid through the start of 2025. But that jobs data was backward looking, and the fear hitting financial markets is about what is to come.

“The world has changed, and the economic conditions have changed,” said Rick Rieder, chief investment officer of global fixed income at BlackRock.

The central question looking ahead is: Will the trade war cause a global recession? If it does, stock prices will likely need to come down even more than they have already. The S&P 500 is down 17.4% from its record set in February.

Mr Trump seemed unfazed. From Mar-a-Lago, his private club in Florida, he headed to his golf course a few miles away after writing on social media that “this is a great time to get rich”.

The Federal Reserve could cushion the blow of tariffs on the economy by cutting interest rates, which can encourage companies and households to borrow and spend. But the Fed may have less freedom to move than it would like.

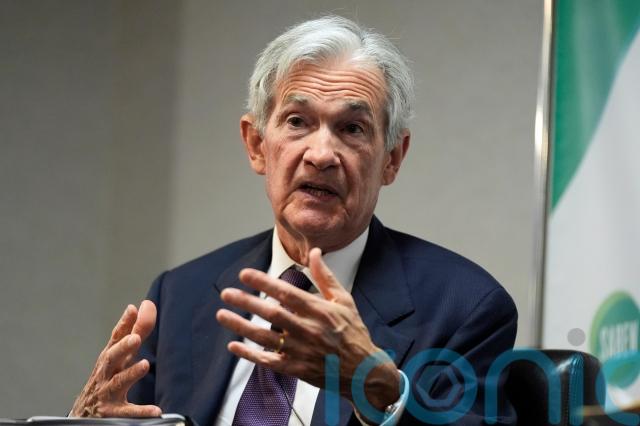

Fed chairman Jerome Powell said on Friday that tariffs could also drive up expectations for inflation. That could prove more damaging than high inflation itself, because it can drive a vicious cycle of behaviour that only worsens inflation. US households have already said they are bracing for sharp increases to their bills.

“Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” Mr Powell said.

That could indicate a hesitance to cut rates because lower rates can give inflation more fuel.

Much will depend on how long Mr Trump’s tariffs stick and what kind of retaliations other countries deliver. Some of Wall Street is holding on to hope that Mr Trump will lower the tariffs after prying out some “wins” from other countries following negotiations.

Mr Trump has said Americans may feel “some pain” because of tariffs, but he has also said the long-term goals, including getting more manufacturing jobs back to the United States, are worth it. On Thursday, he likened the situation to a medical operation, where the US economy is the patient.

All told, the S&P 500 fell 322.44 points to 5,074.08. The Dow Jones Industrial Average dropped 2,231.07 to 38,314.86, and the Nasdaq composite fell 962.82 to 15,587.79.

In stock markets abroad, Germany’s DAX lost 5%, France’s CAC 40 dropped 4.3% and Japan’s Nikkei 225 fell 2.8%.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.